Owner’s funds/Capital/Equity – Last among types of liabilities is the amount owed to proprietors as capital, it is also called owner’s equity or equity. This loan is when a property is used as collateral for obtaining the loan. Mortgage loans, like most loans, are broken down into monthly payments over the period agreed. A normal operating cycle is the time frame needed to convert money to raw materials, finished products, sales, accounts receivable, and money back again.

Examples of Contingent Liabilities

A liability is generally an obligation between one party and another that’s not yet completed or paid. Liability is the money that a business owes a financial institution. Expenses are day-to-day costs a company is expected to pay, such as salaries.

AccountingTools

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. The ratio of debt to equity is simply known as the debt-to-equity ratio, or D/E ratio. Because liabilities are outstanding balances, they are considered to work against the overall spending power of a company. Before this process commences, the executives of a company will deliberate on its financial state.

Accounts Payable

A) They represent ownership in the company.B) They typically require periodic interest payments.C) They have no maturity date.D) They are considered short-term liabilities. Shareholders’ equity represents the ownership interest in a company and is a critical component of the balance sheet. It includes funds invested by shareholders, earnings retained by the company, and dividends liabilities examples distributed to shareholders. Understanding the components of shareholders’ equity provides insight into the financial structure, funding sources, and distribution policies of a company. Key components of shareholders’ equity include common stock, preferred stock, retained earnings, and dividends. Bonds are debt securities issued by companies to raise capital from investors.

Liability Definition

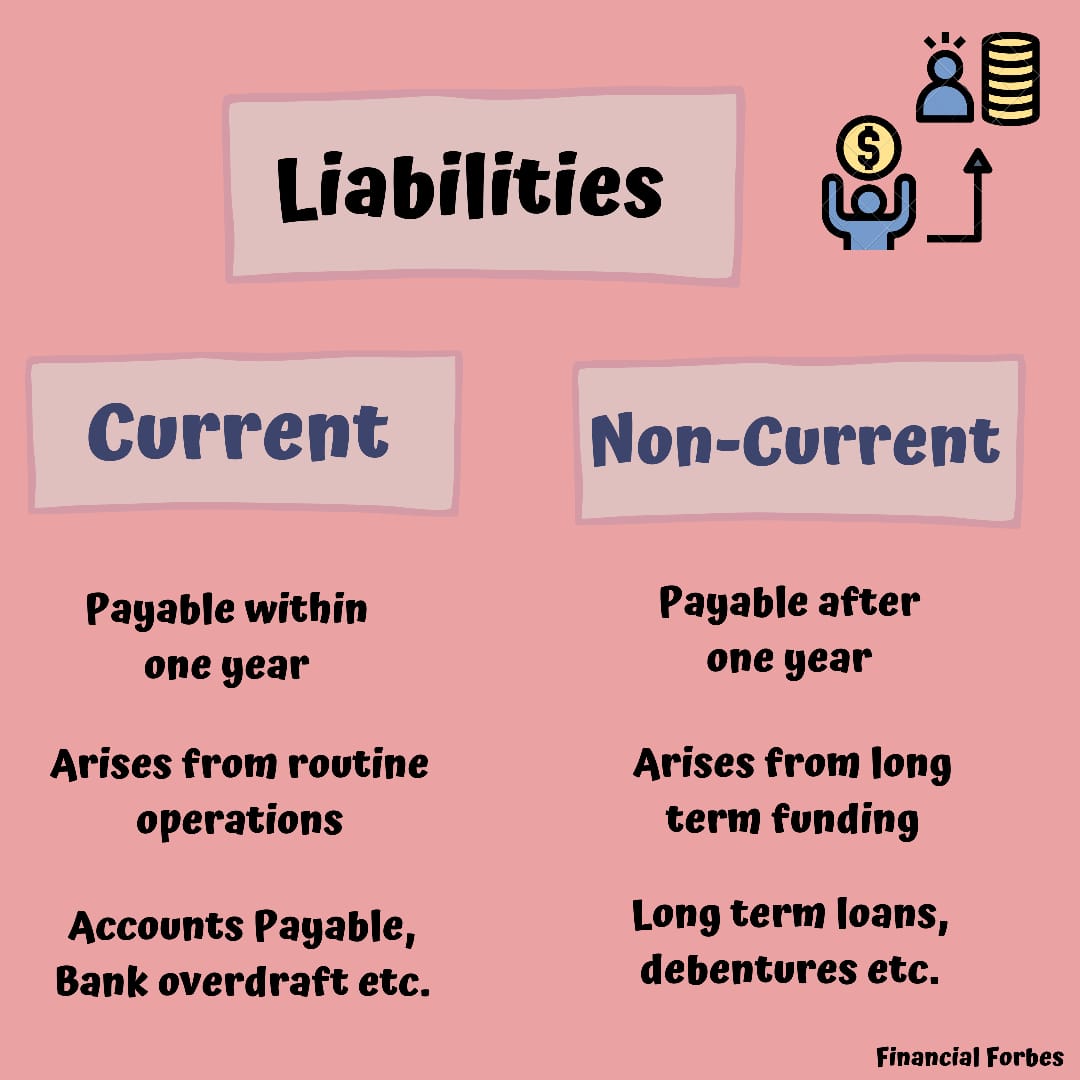

This form of liability is less risky as the time of payment is shorter and immediate. It is easier for a company to pay a debt in three months than to meet up with debts extending beyond a year or even more. This decision is very crucial as they might still be owing current debts to be paid shortly.

Liabilities in the accounting equation

It could be anything, from repaying its investors to paying a courier delivery partner just a modest sum. Non-Current liabilities are the obligations of a company that are supposed to be paid or settled on a long-term basis, generally more than a year. Here is a list of some of the most common examples of contingent liabilities. Here is a list of some of the most common examples of non-current liabilities. Usually, you would receive some type of invoice from a vendor or organization to pay off any debts. If an individual, company, or government’s annual debts exceed their annual income, one may conclude liabilities are “not good” in that instance.

Current liabilities are debts that you have to pay back within the next 12 months. The important thing here is that if your numbers are all up to date, all of your liabilities should be listed neatly under your balance sheet’s “liabilities” section. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Owners are personally liable for all business debts, risking personal assets. A pension liability is the difference between how much money is due to retirees and the actual amount the company has on hand to meet those payments.

Liabilities are a vital aspect of a company because they are used to finance operations and pay for large expansions. For example, in most cases, if a wine supplier sells a case of wine to a restaurant, it does not demand payment when it delivers the goods. Rather, it invoices the restaurant for the purchase to streamline the drop-off and make paying easier for the restaurant. Balance sheet presentations differ, but the concept remains the same. Some businesses prefer the account-form balance sheet, wherein assets are presented on the left side while liabilities and equity are presented on the right (see highlighted part). Unearned Revenue – Unearned revenue is slightly different from other liabilities because it doesn’t involve direct borrowing.

Debt obligations are common among individuals, companies, and governments. Generally, the degree to which liabilities are used often determines their quality. Accounts payable is the firm’s largest current liability, which is often the case among most businesses. Accounts payable are essentially several bills awaiting payment that have not yet been settled. The company’s liabilities are displayed in the middle half of the firm’s balance sheet.

- Debt obligations are common among individuals, companies, and governments.

- Long-term liabilities are obligations or debts that a company expects to settle over a period longer than one year or its normal operating cycle.

- Once the utilities are used, the company owes the utility company.

- Though taking up these finances make you obliged as you owe someone a significant amount, these let you accomplish the tasks more smoothly in exchange for repayments as required.

Unearned revenue arises when a company sells goods or services to a customer who pays the company but doesn’t receive the goods or services. The company must recognize a liability because it owes the customer for the goods or services the customer paid for. These debts usually arise from business transactions like purchases of goods and services. For example, a business looking to purchase a building will usually take out a mortgage from a bank in order to afford the purchase. The business then owes the bank for the mortgage and contracted interest. Some of the liabilities in accounting examples are accounts payable, Expenses payable, salaries payable, and interest payable.

This funding helps businesses generate cash flow and purchase equipment to speed up their production process. Most contingent liabilities are uncommon for small businesses, but here are some that you might encounter. Liabilities are the commitments or debts that a company will eventually have to pay, whether in cash or commodities.